Colorado Electric Vehicle Rebates Explained Movie. Eligible coloradans can receive a $4,000 rebate towards the purchase or lease of used bev or phev. Depending on the ev, coloradans can save.

* xcel rebates cannot currently be combined with state incentives, but utility regulators are. Rebates from the inflation reduction act are not currently available.

How To Get An Electric Vehicle For Less Than $6,000 In Colorado There Are New Changes In Buying An Ev In 2024.

A $6,000 rebate will be available to lease or buy a new electric vehicle valued at less than $50,000, while a $4,000 rebate will apply toward the lease or.

Here’s How You Can Still Save.

New in 2024, ev shoppers have the option to assign their tax credit to a.

Starting In 2024, Individuals May Receive An Additional $2,500 For Evs.

Images References :

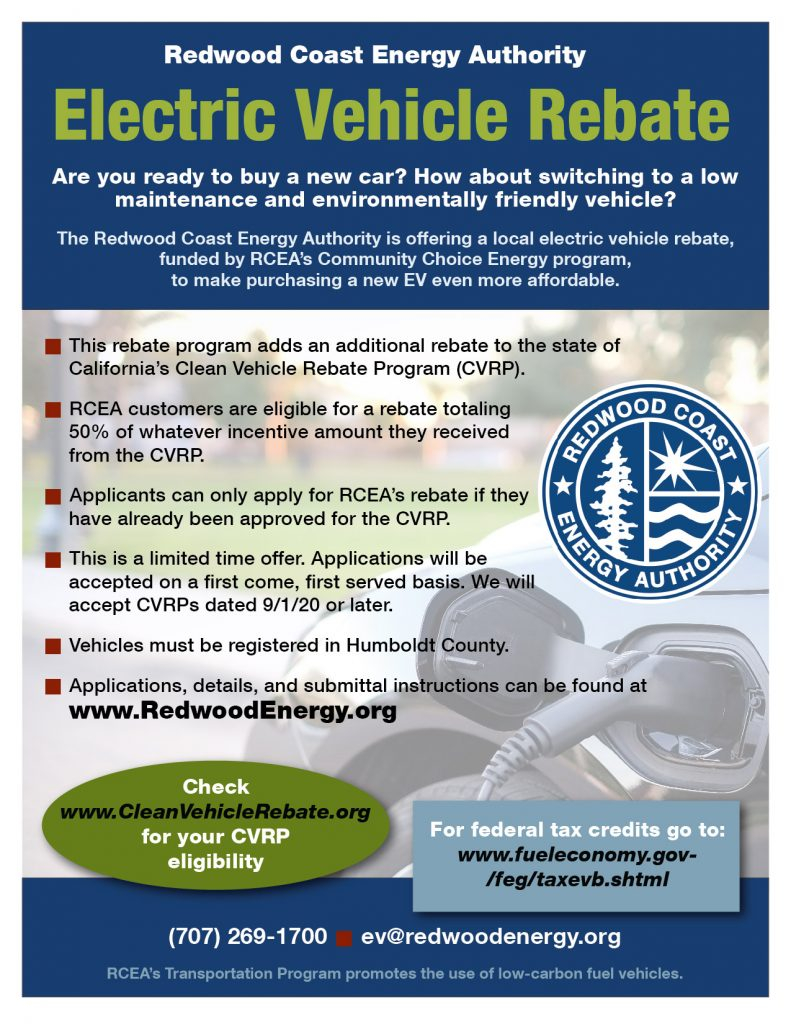

Source: www.pinterest.com

Source: www.pinterest.com

Electric Vehicle Tax Credits and Rebates Explained 2021 TrueCar Blog, Colorado unveiled a plan in 2018 with just that ambition in mind: Inflation reduction act home energy rebate programs.

Source: www.carrebate.net

Source: www.carrebate.net

Electric Car Available Rebates 2023, Are there additional fees for having an electric vehicle? How to get an electric vehicle for less than $6,000 in colorado there are new changes in buying an ev in 2024.

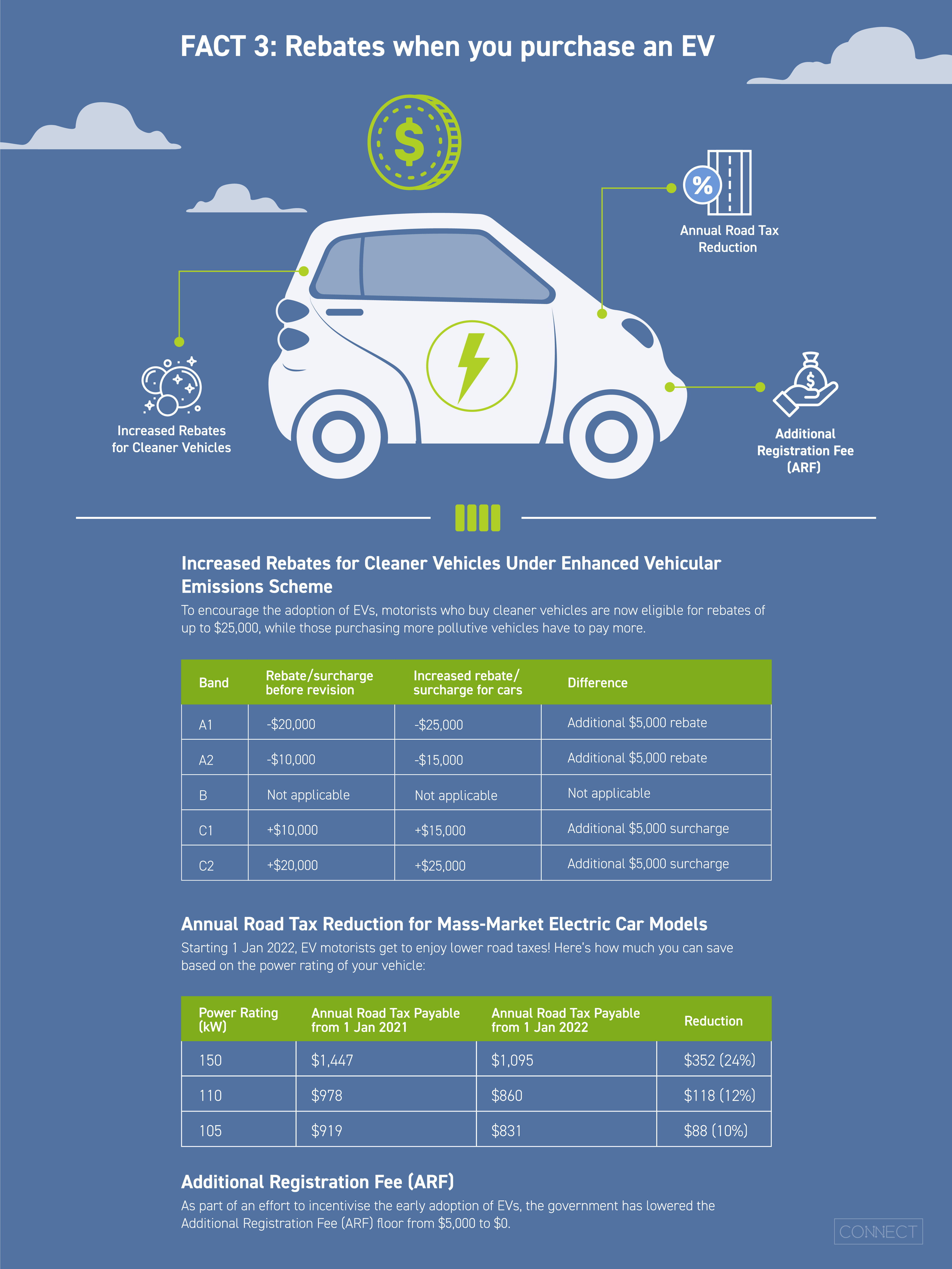

Source: www.lta.gov.sg

Source: www.lta.gov.sg

LTA 8 Facts to Charge Up Your Knowledge About Electric Vehicles, For the purchase or lease of full battery electric or plug in hybrid evs with msrp up to $80,000. Here’s cpr’s guide to all of colorado’s current and upcoming electric vehicle discounts:

Source: www.electricrebate.net

Source: www.electricrebate.net

Electric Vehicle Rebate Phase Out, Eligible coloradans can receive a $4,000 rebate towards the purchase or lease of used bev or phev. Colorado unveiled a plan in 2018 with just that ambition in mind:

Source: www.ggfl.ca

Source: www.ggfl.ca

Electric Vehicle Rebates for Consumers & Businesses Explained, Use this tool to find colorado generally available and qualifying tax credits, incentives and rebates that may apply to your purchase or lease of an electric vehicle. How to get an electric vehicle for less than $6,000 in colorado there are new changes in buying an ev in 2024.

Source: www.constellation.com

Source: www.constellation.com

Electric Vehicle Tax Incentives & Rebates Guide Constellation, In today’s blog post, we’ll take a look at the colorado ev tax credit, the colorado xcel energy rebate, and a bonus alternative to credits and rebates to save on your next ev. Xcel energy’s new roster of electric vehicle rebates is winning praise from environmental groups, with colorado’s dominant utility expanding incentives to include.

Source: driveelectriccolorado.org

Source: driveelectriccolorado.org

Xcel Energy Rebates Drive Electric Colorado, Ev tax credits reduce the amount of income tax you owe to the federal and state government. * xcel rebates cannot currently be combined with state incentives, but utility regulators are.

Source: pirg.org

Source: pirg.org

Electric vehicle tax credits, discounts, and rebates in Colorado, Effective july 1, 2023, the innovative motor vehicle credit. Here’s how you can still save.

Source: evrebates.org

Source: evrebates.org

Electric Vehicle Rebates for the USA, Colorado taxpayers are eligible for a state tax credit of. Effective july 1, 2023, the innovative motor vehicle credit.

Source: www.thezebra.com

Source: www.thezebra.com

Going Green States with the Best Electric Vehicle Tax Incentives The, Xcel energy’s new roster of electric vehicle rebates is winning praise from environmental groups, with colorado’s dominant utility expanding incentives to include. There are so many incentives available for consumers interested in purchasing or leasing an electric vehicle or installing a charger.

Colorado Unveiled A Plan In 2018 With Just That Ambition In Mind:

Up to $21,000 in savings.

Inflation Reduction Act Home Energy Rebate Programs.

* xcel rebates cannot currently be combined with state incentives, but utility regulators are.